In 2022, the second year of the research “Formation of social classes and re-urbanization through real estate development in an eastern periphery of global capitalism” (2021-2023), PCE project 65/2021, Code PN-III-P4-ID- PCE-2020-1730 (REDURB), the project activities included:

– the continuation of the fieldwork, document analysis and literature review (L13 – L 21);

– starting the analysis of the collected research materials (L22 – L24);

– a series of team meetings.

In addition to the interviews done last year (73), in the eight cities where we carried out our fieldwork, in 2022 the REDURB team conducted 72 new interviews.

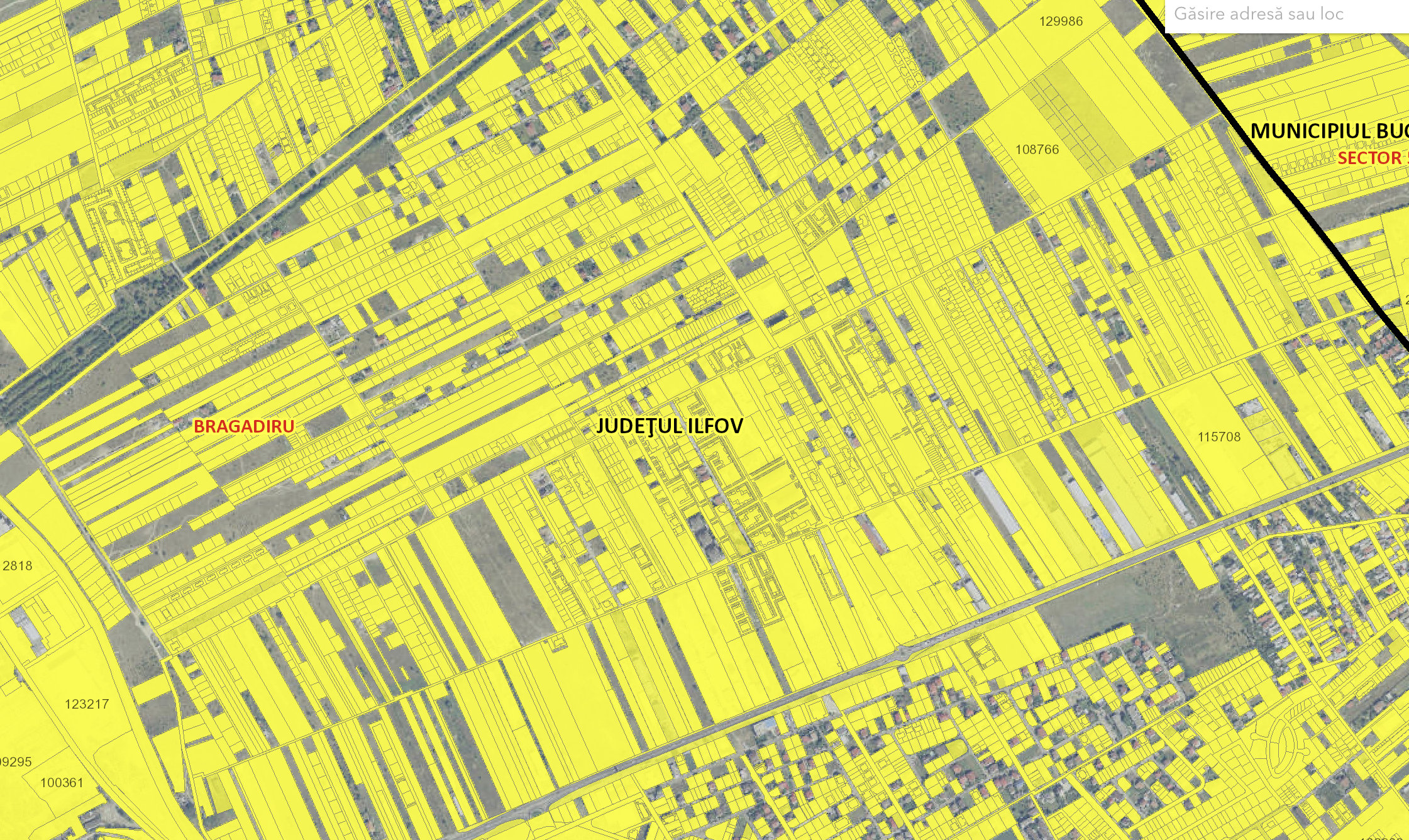

In addition to the information extracted from local documents about the economic context of the cities, we collectively requested and synthesized series of data from multiple resources, such as: databases about companies in industries and real estate development (datagov.ro, termene.ro, Monitorul Official Part IV); statistical information on number of homeowners and number of residential properties (tax departments of the municipalities); statistical information about the local housing stock (patrimony and social assistance departments of the town halls); information on General Urbanistic Plans, Zonal Urbanistic Plans, and building permits (urban planning department of town halls); data accessible in current and historical land-book extracts about real estate (National Agency for Cadastre and Publicity); information on privatization (Authority for the Administration of State Assets); privatization legislation and the multitude of laws related to real estate development, including tax facilities (legea5); data on real estate companies with foreign and Romanian capital, and foreign direct investments (National Trade Registry Office, Romanian National Bank reports); data on population, incomes, housing stock, business statistics, the contribution of various economic sectors to GDP (INS, Tempo online, Ministry of Labor and Social Solidarity); information about the local economic context and directions for future development (development strategy documents at local, county, regional and national level); data on real estate loans (National Bank of Romania).

To coordinate the individual activities of the team members and support the formation of common theoretical-interpretive frameworks, in 2022 we met online in ten workshops with the participation of all members. In addition, we also gathered in several meetings in small groups, to prepare our application for the records of cc 300 real estate properties of interest for the research and then to interpret the information obtained from them. In the online meetings, the researchers supported each other both from the point of view of continuing to collect empirical materials, and from the point of view of their analysis.

In three of the workshops, team members presented their accumulated knowledge from research within the selected cities, in one of the workshops senior researchers presented information on privatization, real estate development and urban politics at national level, and in the last such meeting the whole team presented their reports on fieldwork and ways how the selected cases from the cities speak to the overarching themes of the research. Thus, the team developed a common framework used in the description and preliminary analysis of the selected cities and cases within them, facilitating the transition to the in-depth analysis of the themes studied by the project. At its last workshop this year, in November 2022, the REDURB team discussed possible ways to continue the analysis and write the chapters of the collective volume to be elaborated next year.

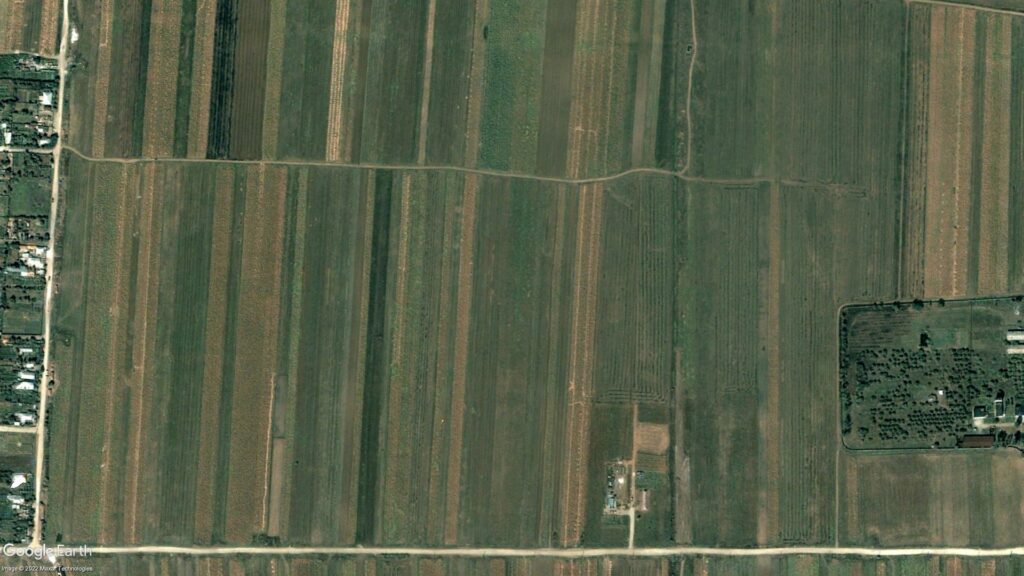

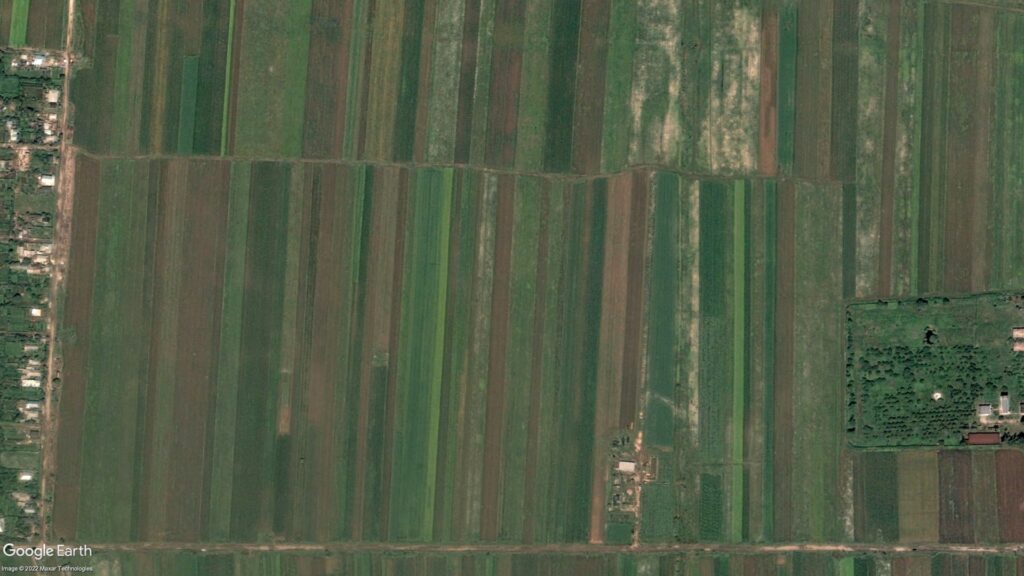

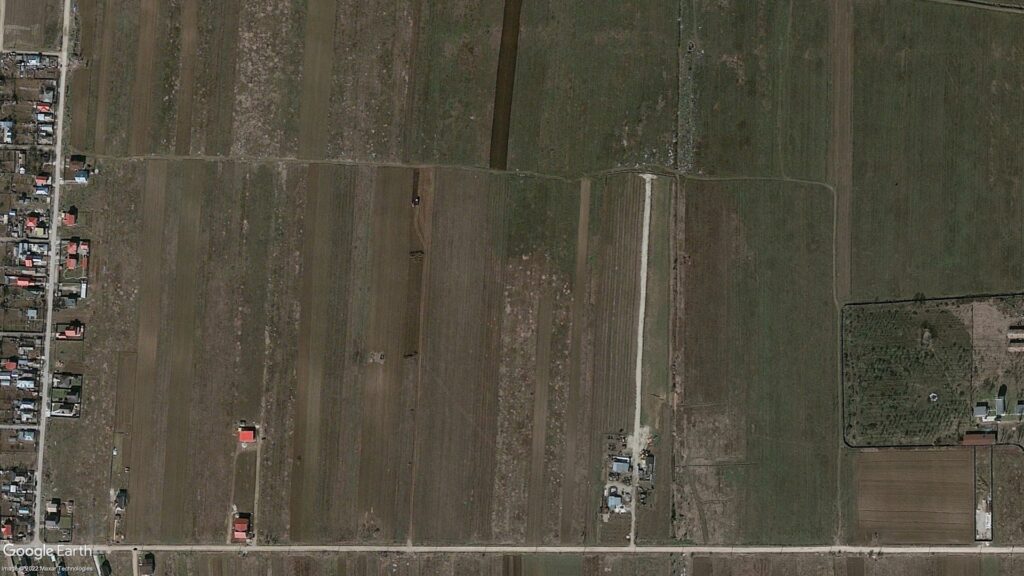

The series of writings from 2022, “Explanatory notes: analytical fieldwork reports”, prepared at the end of the year to be disseminated through the project’s website (https://redurb.ro/note-explicative/) summarizes the empirical material collected in the first two years of REDURB research in the eight cities: Bârlad, Bragadiru, Brașov, Craiova, Cluj-Napoca, Iași, Reșița, Tg Jiu (about which at the end of 2021 we published our series of Field Notes, https://redurb.ro /category/fieldnotes/). The Explanatory notes contain the preliminary analysis of the collected information, articulating the knowledge gathered for each city along the lines of the major sub-themes of the research according to their particularity: privatization of industries and restructuring of the economy/deindustrialization, as a condition for the emergence and evolution of new real estate developments; real estate development as investment and capital accumulation, or business; real estate development as a process of (re)urbanization and/ or sub-urbanization in the entrepreneurial cities; real estate development as a factor in the formation of social classes.

Following the preliminary analysis of the empirical materials collected, we were able to develop the two explanatory schemes below: one captures the conditions necessary for the emergence of real estate development, and the second briefly describes the characteristics of the real estate development regime in Romania.